Phishing has come a long way since Nigerian princes! Cybercriminals are figuring out craftier ways to steal personal information and part you from your money. If you’re not staying up to date you’re putting your business at enormous risk.

Our guide will help you learn all the details about phishing scams and how to keep your SMB protected.

HOW DOES PHISHING WORK?

Phishing scams consist of an attacker sending messages through email, SMS, or over the phone designed to trick the recipient into giving away sensitive information. They will try to convince you they are from a legitimate source, such as your bank or postal services.

Attackers want to fool you into taking a desired action. Things like entering your login information onto a phony login page, “confirming” your credit card details for a popular service, or wiring money to them as they pretend to be one of your vendors.

Most attackers used the “spray and pray” method in the past, sending thousands of messages hoping to fool a few. Malicious messages were easy to identify as they were created hastily. They contained giveaways like grammatical errors and broken English, things that no legitimate service would send out.

Netflix phishing email via ftc.gov

Now they’ve realized people are harder to fool as the public becomes more educated in scams. They’re constantly trying new, more advanced methods to get what they want. Some attacks are designed purposely for an organization after the attacker thoroughly researches their target. Criminals craft phishing emails carefully and format them just like the real deal, making them even more difficult to distinguish.

Some scams fall out of favor after a few years, but phishing is just getting more popular. “Microsoft’s Security team analyzes more than 6.5 trillion security signals a day to identify trends that could affect the digital landscape that we all live in. After scanning more than 470 billion email messages that have been sent and received by customers of its Office 365 platform, the company reports that malicious phishing attacks are on the rise, and not by a small margin — by a massive 250 percent. Worse, techniques used by scammers are becoming more proficient and harder to detect.” (Digital Trends)

As phishing becomes smarter, so must its targets!

WHO IS BEHIND PHISHING SCAMS?

There are hundreds, if not thousands, of people and groups behind various phishing scams. Unfortunately, many cybercriminals remain elusive, so it’s difficult to say where most are coming from.

Cybercrime is a massive business, and oftentimes there are groups of people working together to perpetrate attacks. The end goal is most often money. There have been a few discoveries in the last few years that give us insight into these scammers:

This phishing scam group built a list of 50,000 execs to target (ZDNet)

From the article: “[The phishing group] London Blue operates like a modern corporation. Its members carry out specialized functions including business intelligence (lead generation), sales management (assignment of leads), email marketing (semi-customized BEC attack emails), sales (the con itself, conducted with individual attention to the victim), financial operations (receiving, moving and extracting the funds), and human resources (recruiting and managing money mules),”

Turkish Group Using Phishing Emails to Hijack Popular Instagram Profiles (Dark Reading)

From the article: “A group of Turkish-speaking hackers is hijacking popular Instagram profiles, including those belonging to actors and singers, and, in some cases, promising to turn back control to the victims in exchange for a ransom or nude photos and videos.

Researchers from Trend Micro say they have recently observed several incidents where the group has been using a phishing scam to take over the Instagram profiles of people with between 15,000 and 70,000 followers. They have subsequently changed the primary contact information associated with the breached accounts to lock the original owners out.

The victims have ranged from famous personalities to owners of small businesses like photo equipment rental stores, [Trend Micro] said in a report released Thursday.”

Cybercrime groups continue to flourish on Facebook (TechCrunch)

From the article: “You might be surprised what you can buy on Facebook, if you know where to look. Researchers with Cisco’s Talos security research team have uncovered a wave of Facebook groups dedicated to making money from a variety of illicit and otherwise sketchy online behaviors, including phishing schemes, trading hacked credentials and spamming. The 74 groups researchers detected boasted a cumulative 385,000 members.

Remarkably, the groups weren’t even really trying to conceal their activities. For example, Talos found posts openly selling credit card numbers with three-digit CVV codes, some with accompanying photos of the card’s owner.”

Attackers often congregate on the Dark Web, where they will share techniques, stolen information, and malware to help their cause. Find out if your business’ information is for sale on the Dark Web.

COMMON TYPES OF PHISHING ATTACKS TARGETED AT SMBS

SaaS grab

Many businesses rely on cloud services such as Office 365, G Suite, Dropbox, and Slack. Hackers know there’s huge potential in gaining access to just one account in a company network. Phishing emails in this category will generally attempt to lead you to a fake login page for one of these services. By pretending there was a security incident you need to review, an important notification, or an expired password, they incite urgency and bring your guard down.

If an attacker can gain access to a team member’s account, they can send out phony emails to contacts to get even more information, impersonate the victim, attempt wire fraud, find credentials for and request password resets on other accounts, and gain access to company files.

Best way to avoid: Enable multi-factor (2FA) authentication on any accounts that allow it.

Do not click links or open attachments in emails from services you use unless you 100% trust the sender and were expecting the email. Most reputable companies like Microsoft and Google will not send clickable links or attachments unrequested through email and they will never ask for your personal information.

If you think something’s up with an account, go directly to the service’s website yourself from your web browser and log in without following links from the email.

Mixed messages

Online messaging apps have given attackers another way besides email to scam their victims. Cybercriminals send malicious messages through Facebook, Microsoft Teams, Skype, etc. These platforms generally don’t have the same security or filtering options seen in business email.

Recipients are more likely to click a link or open a file in these programs because while they’ve been trained to be suspicious of emails, messaging platforms haven’t received the same attention.

Best way to avoid: Train employees to use caution with any messaging platform, and make them aware that cybercriminals are utilizing these apps. Some third-party tools also exist to help secure online messaging programs.

Let’s (business email) compromise

BEC attacks are on the rise as a successful one can easily net hundreds of thousands or even millions of dollars in one swoop for the perpetrator. “According to CNBC, law enforcement agencies have dealt with over 17,000 victims who have collectively lost more than $2.3 billion to BEC attacks.” (VadeSecure)

Sometimes you’ll hear this referred to as CEO, wire fraud, or invoice phishing. By compromising an executive’s email account, an attacker can dupe another employee (usually a financial manager) into wiring money to them. This is easily accomplished by going through old messages, finding a vendor the company’s previously sent money to, and changing only the routing/account information. Most people won’t check that the account numbers match previous payments and will send the money right off to the criminal’s account.

The rise of social media and large-scale data breaches have made these attacks more effective in recent years. A criminal can easily find a company’s hierarchy and personal information on social media. Coupled with credentials found through data breaches, it’s all too easy for an attacker to convincingly impersonate and/or take over the account of someone at your business.

Best way to avoid: Many banks, especially business banks, will allow you to set up extra security features before they process any transfer or vendor payment. Examples include sending a code to your email or phone as in two-factor authentication, creating a pin or password, and requiring two people at your company to approve the order.

We also recommend requiring something like this internally regardless of your bank setup. If a request comes through email, have that employee confirm the request through a different channel i.e. text, phone call, in person, or a messaging program.

Sharing isn’t caring

Attackers are figuring out ways to circumvent email security features like scanning for malicious links. Criminals will upload dangerous files within sharing services like Dropbox or Google Drive, then send a link to that file to the victim.

Since the link within the message is from a reputable service, most security filtering settings won’t flag it. But once the victim follows the link and falls for the scam, their information is stolen, malware installed on their machine, etc.

Best way to avoid: As always, never click links in emails unless you were expecting it! Confirm with the person who appears to have sent the message through an alternate channel – phone, in person, text.

Kill bill

This email is a common target for both businesses and consumers. It will attempt to convince you that there’s been a billing issue with a service you use – Netflix, Paypal, etc. Just click the link in the email to verify your information and clear everything up! Or, more likely, you’ll send your financial, login, and/or personal information straight to the perpetrator.

Best way to avoid: Once again, NEVER follow links from emails you aren’t expecting. If you want to check the validity of an email like this, call the company directly or visit the website and log in from your web browser. If there is a billing issue, you’ll be able to see it straight away.

Companies are aware that phishing scams like this are prevalent. They will generally never ask you to follow a link or confirm personal information from an email.

Taxation without representation

Tax season is, of course, when this scam is at its peak and it comes in a few flavors. Some emails state that you’re eligible to receive a refund, or that you are being audited. Both want you to give up personal information.

In another variation, an attacker pretends they’re with a vendor or adviser and attempt to “confirm” employee tax information.

Best way to avoid: The IRS will pretty much always send you important information through snail mail. They will never ask you to confirm personal or financial details over email or even the phone.

If a vendor or adviser calls or emails trying to get employee information, have a system in place to confirm these requests before giving anything out. This could entail channeling everything through your CEO or another person who is familiar with all your vendors, and/or requiring all requests be made via certified mail.

HOW TO SPOT A PHISHING SCAM

Many phishing emails you’ll receive are clearly fake. They’re littered with spelling and grammatical errors, obviously false email addresses, and nonsensical instructions. But, these attacks become more sophisticated every day. Many are difficult to distinguish as fake. Don’t let your guard down expecting that they will always be obvious! Here are a few techniques they use and how to spot them:

Fake links

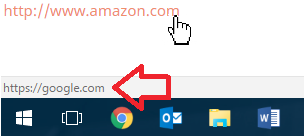

Hyperlinks can look like they will go to a legitimate site, but they can actually point wherever the creator wants. For example, you would expect clicking this link: https://www.amazon.com would take you to Amazon, right? However, I’ve told the code powering it to direct the clicker to Google instead.

The text shown and the actual link destination don’t have to match whatsoever. This is how scammers trick people into thinking they’re going to something like their bank website when in fact they’re going to that scammer’s fake bank login page.

So how can you tell where a link will take you? Hover your mouse cursor over the link without clicking. A bar will pop up in the lower-left corner of your screen. This shows where you will go when you click. Here’s an example with that same Amazon-Google link trick:

Email address spoofing

Spoofing really just means faking. Scammers mask their sending address to make it look like their email is coming from someone else. This could be a trusted organization, family member, or friend to improve the chance that you’ll click on their link.

Unfortunately, there is really no easy way to determine when this is happening just by looking at the address. Best practice is to not click links in these emails unless you were expecting them. Contact the sender by phone or in-person when in doubt.

People whose email accounts are compromised often also send out mass emails with bogus links.

Website dupes

Fake links in emails often lead to phony websites, clones of reputable sites that attackers hope will trick you. It may look like you’re on Facebook’s login page, but you’re about to send your credentials to a criminal! Always be aware of what you’re clicking on, and what the page URL you’re on looks like. Many people won’t take the time to notice where they’re actually about to log in.

To make the fake website issue worse, attackers can do what’s called pharming. This method allows the criminal to redirect you to a malicious website from a reputable website. For example, you could type in “business.com” and if it’s been overtaken by pharming, you’ll be sent to “terrible-infected-website-that-will-steal-your-soul.com” instead.

Ensure you’re checking the URLs of any website you need to enter personal or financial information into. Using antivirus and/or a content filtering program will also help prevent any issues by blocking the malicious website from loading.

To click or not to click?

It’s best to treat emails with links like emails with attachments. If you are expecting the email – say you just ordered a package from Amazon and receive an email with your tracking code – go for it. If the email is out of the ordinary, unexpected, asks you to confirm/enter financial or personal information, or looks “phishy” in any way, it’s best to err on the side of caution.

Businesses that handle financial and personal information have strict rules against ever asking you for information over email. You can always call to confirm the information from the email. Or, manually log into the website account in question without following the provided link.

HOW TO HANDLE A SUCCESSFUL PHISHING ATTACK

While these are steps we like, we recommend always checking with your dedicated IT person or company before doing anything. They likely have a preferred method based on the company’s needs and setup. Trying to handle something your own way may mess that up!

If your business has fallen victim, here are some steps you can take to minimize and reverse any damage:

Engage the help of your IT support

If you don’t have a full-time person or team, get in touch with a trusted service provider. But be aware you may have to pay emergency rates!

Identify the source of the breach

This should also include which users were involved. But don’t shame or embarrass them! You want to encourage a culture of openness, especially around security. The damage is done, whether they try to hide it or not. The more information you can get from them to prevent issues in the future, the better. Ask why they clicked/entered their information, what they thought was convincing about the scam, and what happened before/during/after they were victimized.

Alert your financial partners

Let your business banks know what’s going on and set up charge alerts if you haven’t already. If you suspect your debit/credit cards may have been compromised, request new ones.

Do clean up

Attacks on businesses are often out for credentials and information they can use later. Have the team change the passwords of any accounts that use the same login information as the stolen one. Completely changing all business passwords is even better.

Turn it into a learning session

Once everything is back to normal, it’s a great time to up you and your team’s security knowledge. An IT or security consultant/trainer could come in to conduct a team training. You can find tons of resources online to send to your team (like this one!) You can even use tools to conduct simulated phishing attacks to find and remediate the weak points in your company. Check out the next section for links to some of these resources.

ADDITIONAL SECURITY TRAINING AND RESOURCES

The Business Guide to Cybersecurity (eBook)

How to Create (and Remember!) Strong Passwords (Article)

IronScales – Attack simulation, awareness training, real-time threat protection for your email accounts

KnowBe4 – Security awareness training and simulated attacks

PhishProof – Phishing simulations and reporting

Phishd – Simulated phishing attacks, training, security audits, and reporting