Accounting as a discipline has roots dating back to thousands of years and was used by ancient civilizations as an auditing system including in Babylon, Egypt, and Mesopotamia.

Over the years, it has evolved considerably, and today we have arrived in an era where artificial intelligence is making its grand entry and undoubtedly revolutionizing one of the oldest professions in the world.

Without question, AI will bring about a pivotal change and is the ideal candidate for disruption in the ways accounting is carried out in current times.

According to a recent study by Finances Online, 80% of executives believe that AI in accountancy offers them a competitive advantage. Furthermore, 79% of business owners claim that AI can serve as the key to increasing their company’s productivity.

Moreover, 66% of accountants state that they are willing to invest in AI, while around 55% are already planning to utilize it to full capacity. The views are unquestionably in favor of AI’s induction into the accounting profession.

In light of this information, let’s take a quick look at some of the ways through which artificial intelligence will change and impact the accounting industry in 2021.

AUTOMATION

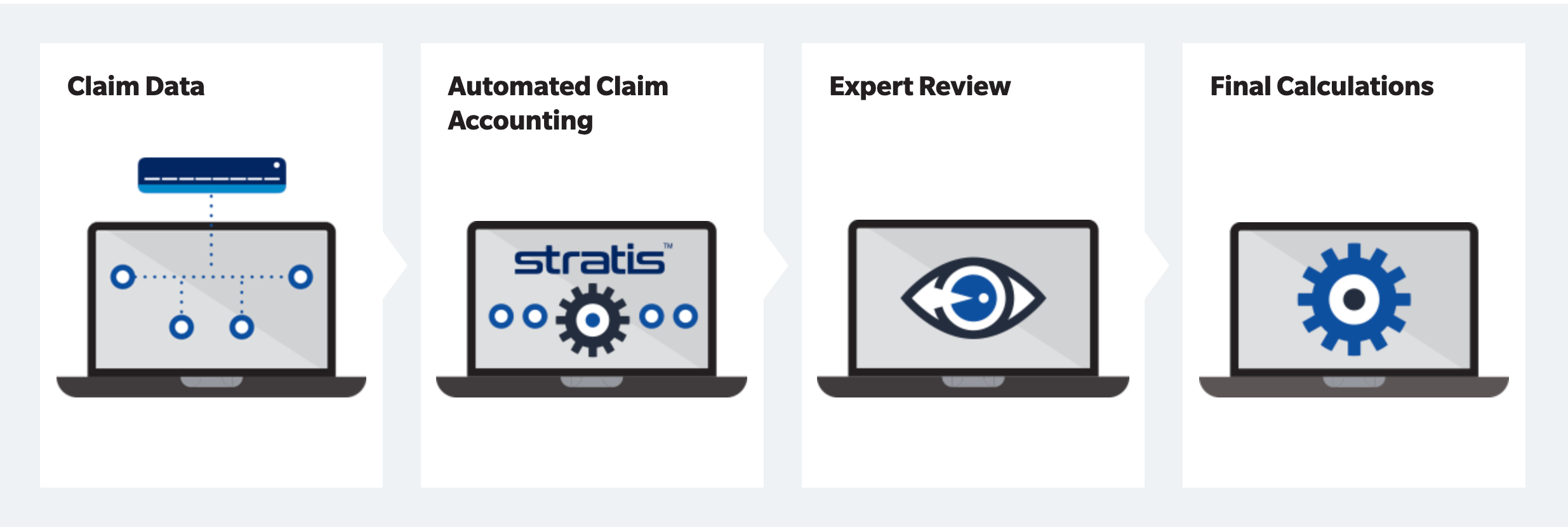

Keeping track of transactions can be time-consuming and downright tedious at times. This is where AI, with its incredible ability to crunch data sets, can be used to extract viable information as well as store images of receipts. With additional programming, AI can also be instructed to classify various information based on their nature of use and automate spending categories.

With the help of AI, accountants will be able to obtain automated reports that can then be analyzed for further inferences.

One fine example of this can be observed with AppZen Inc.’s help; a company founded in 2012 that offers automation for corporate spending policies and achieves 100% auditing compliances for all expenses.

CLOSING TECHNICAL GAPS

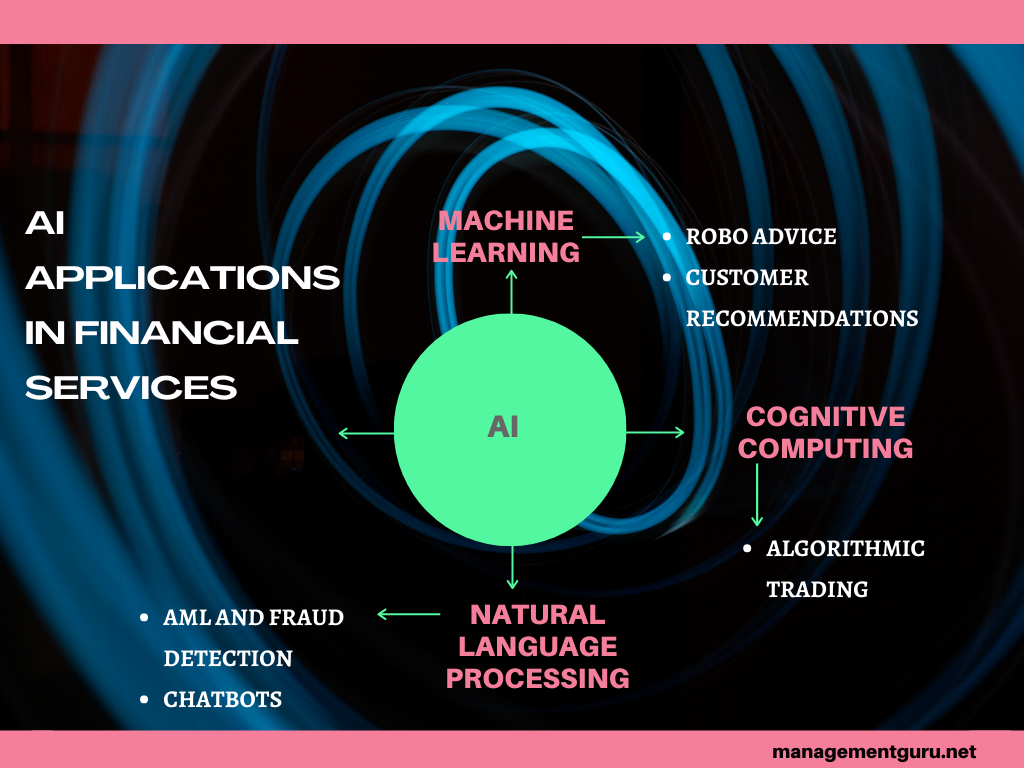

By closing technical gaps actually refers to enforcing corporate policy and also reducing the risk of fraud. It is natural to consider the threats of malicious activity whenever huge sums of finances are involved because that is the world we live in, and that’s what our history showcases as well.

However, with AI acting as the supporting backbone to the system, corporate policies and best practices can be enforced.

Furthermore, reducing errors and overcoming loopholes AI can also be used to audit 100% of spending reports, thus resulting in fraudulent activities. YapPay Inc. is a software company headquartered in San Francisco that does something similar.

By leveraging AI, it can predict cash flows along with total cash visibility and accounts receivable activity tracking.

DATA ANALYTICS

Data scientists and data engineers can offer a business analyst and others proficient data analytics with AI. While this simplification of processes is projected to spread quickly, this would help develop tools that employees can use for accounting, auditing, and financial operations.

When that happens, even novices without technical supervision would be able to acquire terrific insights, and naturally, this would lead to a revolution in accounting.

Vicai Inc., a software company, founded in 2016, offers an AI platform for remote accounting firms and enterprise finance. They offer AI that learns from your interactions and rapidly provides suggestions for improving performance.

FRICTIONLESS INTEGRATION

24SevenOffice is a Norwegian software company headquartered in Oslo, Norway. They offer accounting that is fully integrated with artificial intelligence that allows document management and bookkeeping.

Through this integration, hundred and millions of invoices and pertaining data is analyzed while offering users complete control when it comes to approval.

Through machine learning and big data analysis, AI can offer deep insights and complete system automation for managing invoices and other bookkeeping tasks. All of this allows for a tremendous potential to streamline and automate documentation as well as workflows.

Many young pupils who pay for essay UK are also looking forward to the integration of technology that can help them further with their academic-related tasks.

PREDICTIVE ANALYSES

With the ability to produce business insights that lead to a better decision-making process, AI can learn from data and information patterns to derive its own forecast and projections. Based on computational knowledge and inferences derived from accurate studies of existing trends, AI can be used to provide predictive analysis for accounting firms.

SMACC is a company that offers automation of data extraction from accounting entries, invoices, and financial planning on a single platform. With SMACC’s application, small to medium-sized enterprises can obtain real-time data to aid the overall decision-making process.

STANDARDIZED PROCESSES

Accounting seeks to deliver a streamlined process for managing financial information for businesses and corporations. However, while accounting is carried with extreme diligence, there are always instances where procedures are missed, and discrepancies are observed.

This is where AI can be a powerful tool to standardize the process and carry out tasks in a streamlined manner. Agilize Europe is headquartered in Milan, Italy. It utilizes machine learning algorithms to classify data scanned from devices to create accurate accounting records.

CONCLUSION

AI’s potential is yet to be fully realized for the accounting and finance industry. Today we merely see the beginning of automated software applications that can grow into comprehensive systems to provide solutions at a global scale in the near future.

I hope this post was helpful in offering you meaningful insights as to how AI will impact the accounting industry in 2021. For now, let’s keep our fingers crossed and see where the latest developments in the tech world can take us.